What is the SIP calculator and its complete details?

What is an SIP Calculator:-

The systematic Investment Plan (SIP) calculator is an online tool. With which you can invest in mutual funds. Before investing in SIP, you should first know that the calculator works by keeping in mind your monthly investment amount and investment period. Frenzy can estimate that in January 2023, there has been an inflow of 13 856 records.

- SIP is a process of investing in mutual funds every month.

- How can a SIP return calculator help you?

- According to many mutual fund experts, SIP is a more attractive way of investing than a lump sum amount.

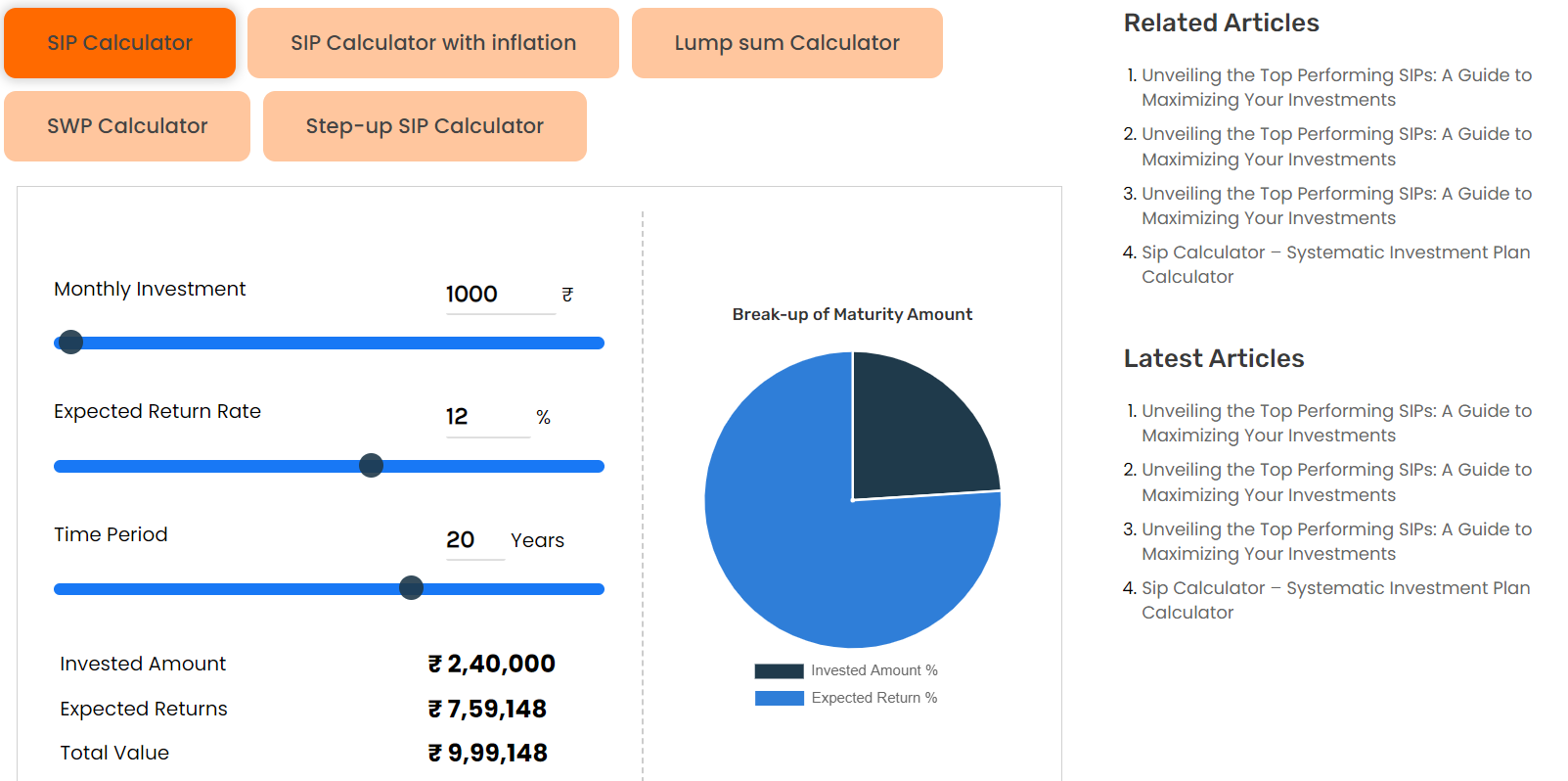

We can also use the SIP calculator online and that too for free. You just need to enter a few values and once you input the investment amount, investment period, and expected return rate, the calculator will give you the value of your SIP investment. This tool helps you save time by doing calculations.

The SIP calculation is done as follows:-

M = P × ({[1 + i]^n – 1} / i) × (1 + i)

M:- Represents the amount received on maturity

P:- Represents the amount invested

n:- Represents the number of payments made

i:- Represents the interest rate

How do you use the SIP calculator?

1. Decide your fixed amount:-

First of all, you have to decide how much money you want to invest.

2. Enter the number of your SIP installments

Estimate the number of times you want to make SIP, like once a month, every week, or every quarter.

3. Choose the periodicity of SIP payments

Estimate the frequency of your SIP payments, like every month, every week, or every month.

4. Enter the rate of expected return

Estimate the profit you will get. Remember, the rate of return can change.

5. Click on “Calculate”

After filling in all the details, click on the “Calculate” button—the calculator will give you an estimate of how much property you will have collected at the size of your knife.

You may have some questions like these:-

- How does the SIP calculator work?

- What is the difference between different SIP calculators?

- Are the calculated results of SIP completely correct?

- Investing in SIP is easy but it also involves risk.

Advantages of SIP:-

- The SIP calculator helps you determine how much money you should invest.

- Using a SIP is very easy, anyone can do it, and that too for free.

- SIP Calculator solves your problems

Tips:-

You should invest keeping your goals in mind.

Let’s Take A Look threw an Example:

Investing ₹1000 monthly in a SIP at a 20% annual interest rate results in the following future values:

- For 10 years: approximately ₹3,82,364

- For 20 years: approximately ₹31,61,479

- For 30 years: approximately ₹2,33,60,802

- For 40 years: approximately ₹17,01,74,628

- For 50 years: approximately ₹1,23,72,54,950

Conclusion:- SIP is a useful tool that helps applicants to assess their future investment amount. These indicate how they can achieve their financial goals through regular investments and the company. Investing through SIP is a safe and disciplined method, which reduces the risks arising from market fluctuations. Thus, using the SIP calculator informs investors in their investment decisions and enables planning.